Table 2 – Comparison between each regulated community

| PSC | FSC (RAV) | DCV Total | ||

|---|---|---|---|---|

| Total inspections | 2,797 | 106 | 2,654 | 5,557 |

| Total detentions | 176 | 4 | 81 | 261 |

| Detention % | 6.3% | 3.80% | 3.05%* | 4.70% |

| Total Deficiencies | 7,491 | 416 | 9,733 | 17,640 |

| Deficiencies per inspection | 2.68 | 3.92 | 3.67 | 3.14 |

Priority Groups – How do we prioritise inspections?

PSC Inspection Targeting

Foreign flagged ships are generally eligible for PSC inspection every 6 months. For eligible ships, AMSA applies a dynamic risk profiling system to assist in allocating PSC inspection resources in the most effective manner. The risk factor does not mean the ship is a high risk as such, it is simply a statistical tool to prioritise inspections.

FSC Inspection Targeting

Regulated Australian Vessels (RAVs) are also eligible for inspection every 6 months, similar to the eligibility of foreign ships for PSC inspections and AMSA applies the same dynamic risk profiling system to RAVs as to PSC inspections.

DCV Inspection Targeting

For DCVs, targeting is calculated for the Australian financial year (1 July to June 30). AMSA employs a targeting prioritisation model for DCVs that is risk-based. Several factors are used to calculate a risk score for DCVs including compliance history, age of a vessel, construction, operation, and certification status. The higher the risk score the more frequently a DCV is likely to be inspected.

AMSA continues to refine the DCV risk calculator based on evolving inspection data, allowing further refinement of risk scores and prioritisation.

For details of the DCV targeting models used during 2023, refer to the AMSA National Compliance plans for 2022-23 and 2023-24:

https://www.amsa.gov.au/national-compliance-plan-2022-23

https://www.amsa.gov.au/ncp23-24

What is a deficiency?

PSC & FSC (RAV)

The IMO defines a deficiency as ‘a condition found not to be in compliance with the requirements of the relevant convention’. Serious deficiencies contribute to the ship being substandard or unseaworthy. AMSA will issue a ship with a deficiency if it is determined, or reasonably suspected, that the condition of a ship, its equipment, or performance of its crew does not comply with the requirements of relevant international conventions.

As shown in Appendix 1, Table 8, the deficiency rate remained the same in four out of five deficiency types in PSC from 2022 to 2023, with a small increase in the rate of Structure/equipment deficiencies.

Deficiencies by category and ship type

PSC deficiencies

For reporting purposes, deficiencies have been categorised into groups that identify key areas of non-compliance, being structural/equipment, operational, human factors, ISM (safety management) and MLC (living and working conditions). Appendix 1, Table 6 identifies the number of deficiencies by category in 2023 along with a comparison of the deficiency rates to those in 2022.

If the number of deficiencies is considered in isolation, as depicted in Table 6, the majority of deficiencies were issued to bulk carriers. However, this is not surprising given bulk carriers accounted for 50.4% of ship arrivals and 51.6% of all inspections. To assess the performance of ship types, it is necessary to compare the deficiencies per inspection for each category as provided in Appendix 1 table 7. Ships with less 10 inspections have not been included in the below summation.

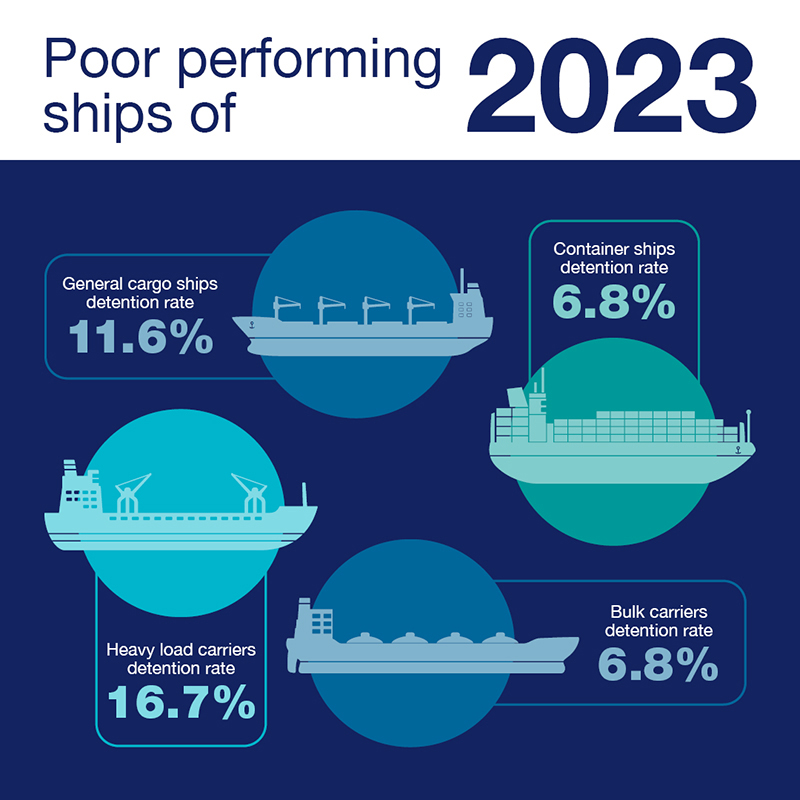

Poor Performing Ships

- Heavy load carriers were the poorest performing ships in 2023, with a detention rate of 16.7%.

- Offshore service vessels were the next poorest performing ship type with a detention rate of 12.5% percent.

- General cargo/multi-purpose ships were the next poorest performing ship type with a detention rate of 11.6%, followed by chemical tankers with a detention rate of 8.1 % and gas carriers with a detention rate of 7.5%.

Container ships dropped out of the top 5 poorest performing ship types in 2023 with a 6.8% detention rate, a notable improvement from the 2022 rate of 8.3% but still above the 6.3% average for all ship types. The rate of deficiencies per inspection for container ships was 3.59, well above the 2.68 average deficiency rate for all ship types. AMSA is continuing to focus on enforcing the minimum international standards for container ships including the proper stowage and securing of containers and maintenance of cargo securing equipment.

- In 2023, bulk carriers exited the top 5 poorest performing ship types after being on the list for 7 years. This is significant as bulk carriers are the most frequently inspected foreign flagged ship in Australia, with 1,444 PSC inspections conducted in 2023. The detention rate for bulk carriers in 2023 however was 6.8%, higher than the 2022 rate of 6.4% and above the 6.3% average for all ship types. This indicates that the performance of bulk carriers has not improved despite dropping out of the top 5 poor performing list. The rate of deficiencies per inspection for bulk carriers was 2.84, slightly above the 2.68 deficiency rate for all ship types.

Appendix 1, Tables 6, 7 & 8 provide more granular information on deficiencies issued during 2023 PSC inspections.

DCV deficiencies

Marine Safety Inspectors will issue a DCV with a deficiency if they reasonably believe that a condition on the DCV is in contravention of the National Law Act 2012, including associated regulations and standards. Deficiencies which are assessed as having a high risk to safety of persons or the environment will likely lead to further compliance action.

The most common deficiencies by deficiency type on DCVs in 2023 were for life saving appliances (23% of all deficiencies), followed by SMS (20% of all deficiencies) and Fire Safety (15% of all deficiencies). These three deficiency categories account for 58% of all deficiencies issued to DCVs. More detail is provided in Appendix 2, Tables 3 and 5.

The highest deficiency rates (deficiencies per inspection) by vessel class for DCVs in 2023 were for passenger vessels (4.39) and fishing vessels (3.75), followed by hire and drive vessels (3.46) and non-passenger vessels (3.44). Fishing vessels had the highest share of detainable deficiencies recorded (34.5%), followed by non-passenger vessels (34.1%), passenger vessels (25.0%) and hire and drive vessels (6.4%). Refer Appendix 2, Table 6 for more detail.

FSC deficiencies

The highest deficiency rates by deficiency category for RAVs in 2023 were for structural/equipment (2.18), followed by operational (0.87) and human factor (0.51). More detail is provided in Appendix 3, Table 2.

The highest deficiency rates by ship type for RAVs in 2023 were for passenger ships (5.90), followed by ro-ro cargo ships (4.67) and tugboats (4.63). More detail is provided in Appendix 3, table 1.

Appendix 3, Table 1 & 2 provide more granular information on deficiencies issued to RAVs

Comparison between regulated fleets

Table 5 - Comparison of deficiency rates per category between each regulated fleet for 2023

| Structural/ equipment | Operational | Human factor | ISM/SMS | MLC | |

|---|---|---|---|---|---|

| PSC - Totals | 3,938 | 1,144 | 1,021 | 358 | 1,030 |

| category deficiency rates | 1.41 | 0.41 | 0.37 | 0.13 | 0.37 |

| RAV - Totals | 231 | 92 | 54 | 10 | 29 |

| category deficiency rates | 2.18 | 0.87 | 0.51 | 0.09 | 0.27 |

| DCV - Totals | 5,358 | 1,665 | 188 | 1,927 | 595 |

| category deficiency rates | 2.02 | 0.63 | 0.07 | 0.73 | 0.22 |

Based on the table above, it can be concluded:

- Structural/equipment deficiencies were again the most common type of deficiency from any inspection in 2023. RAVs and DCVs had a particularly high deficiency rate in this category compared to foreign flagged ships (PSC).

- SMS deficiencies are issued at a significantly higher rate on DCVs. A contributing factor is that, unlike PSC or FSC, multiple SMS deficiencies can be issued during a single DCV inspection. This is generally to assist the master or owner in clearly identifying areas of the safety management system that require improvement.

- RAVs had an operational deficiency rate over twice that of foreign flagged ships.

Detention – PSC & FSC (RAV)

What is a detention?

The IMO Guidelines on PSC define a detention as: ‘intervention action taken by the port State when the condition of the ship or its crew does not correspond substantially with the applicable conventions to ensure that the ship will not sail until it can proceed to sea without presenting a danger to the ship or persons on board, or without presenting an unreasonable threat of harm to the marine environment, whether or not such action will affect the scheduled departure of the ship.

Australia is aware that a ship detention is a serious decision, and only makes the decision where a ship cannot set sail without presenting a danger to the ship, persons onboard or a threat of harm to the marine environment.

In line with the IMO Guidelines, ships which are unsafe to proceed to sea will be detained upon the first inspection, irrespective of the time the ship will stay in port; and the ship will be detained if the deficiencies on a ship are sufficiently serious to merit a PSCO returning to the ship to be satisfied that they have been rectified before the ship sails.

Detainable deficiencies

PSC detainable deficiencies

Table 9 shows the proportion of detainable deficiencies in different categories over a two-year period. As indicated in the table, the detainable deficiencies relating to the category of ISM remained the highest, with a small decrease in overall share in 2023 (27.0%) as compared to 2022 (29.1%). The category of fire safety again accounted for the second highest share of detainable deficiencies (15.2%). There was a notable increase in the share of detainable deficiencies for water/weather-tight conditions which almost doubled in 2023 (12.6%) compared to 2022 (6.4%). The share of detainable deficiencies related to labour conditions decreased in 2023 (4.2%) compared to 2022 (7.3%). AMSA takes a serious stance on enforcing seafarer rights and these numbers indicate that this may be having the desired effect in improving the welfare of seafarers.

The ongoing high proportion of detainable deficiencies under the ISM code highlights the important role port State control plays in identifying, and bringing into compliance, ships that have become substandard due to the lack of implementation of an effective safety management system. In 2023, AMSA continued to focus on the planned maintenance requirements of the ISM code in response to prior incidents related to lack of maintenance of main engines and power generation systems.

https://www.amsa.gov.au/about/regulations-and-standards/102022-planned-maintenance-ships

DCV detainable deficiencies

For deficiencies that are a high risk to safety of persons or the environment, AMSA may use a National Law notice to ensure that the DCV does not operate until the high-risk deficiency is rectified. This could be in the form of a prohibition notice, a direction notice or a detention notice.

The most common detainable deficiency type for the DCV fleet in 2023 was structural conditions, accounting for 22.3% of all detainable deficiencies (49 in total). Safety management system deficiencies were the second most commonly detainable item accounting for 19.6% (43 in total) followed by fire safety at 18.2% (40 in total). These three categories accounted for over 60% of all detainable items found on DCVs.

Appendix 2, Table 7 provides more information regarding detainable deficiencies on DCVs.

RAV Detainable deficiencies

Appendix 3, Table 3 outlines detainable deficiencies by deficiency type for RAVs. The low occurrence of detainable deficiencies in 2023 does not provide scope for statistical analysis.

High Performing Operators - PSC

When considering ship performance, AMSA also considers the performance of operators in respect of the detention and deficiency rates of the ships they operate. In this report, AMSA has identified operators that are considered to be high performing. This is assessed on the following basis:

- At least 10 inspections during the year (less than 10 is not statistically significant)

- No detentions during the year

- A deficiency rate at no more than 70% of the average deficiency rate for the year.

Applying these criteria to data for 2023, AMSA identified 21 high performing operators as listed

| Company Number | ISM company name | PSC Inspections | Deficiency Rate |

|---|---|---|---|

| 5861351 | Rivtow Marine Pty Ltd | 11 | 0.00 |

| 5527921 | Swire Shipping Pte Ltd | 16 | 0.31 |

| 0104949 | OCEAN S SA | 10 | 0.60 |

| 5261954 | MOL SHIP MANAGEMENT (SINGAPORE) PTE LTD | 13 | 0.62 |

| 1968365 | WALLEM SHIPMANAGEMENT LTD (WSM) | 15 | 0.67 |

| 1578540 | CSC Nanjing Tanker Corp | 14 | 0.86 |

| 5634079 | DORVAL SHIP MANAGEMENT KK | 24 | 0.88 |

| 6069701 | Stolt Tankers BV | 10 | 0.90 |

| 5912498 | COSCO SHIPPING TANKER (SHANGHAI) CO., LTD | 11 | 1.00 |

| 5089202 | ANGLO-EASTERN (ANTWERP) NV | 15 | 1.07 |

| 6071296 | Hoegh Autoliners Management AS | 29 | 1.07 |

| 0752001 | Hachiuma Steamship Co Ltd (Hachiuma Kisen KK) | 11 | 1.09 |

| 1941881 | OLDENDORFF CARRIERS GMBH & CO KG | 30 | 1.10 |

| 5614632 | Anglo-Eastern Maritime Services Pte Ltd | 19 | 1.11 |

| 1966806 | Maran Dry Management Inc | 16 | 1.19 |

| 5105614 | PACIFIC BASIN SHIPPING (HK) LTD | 40 | 1.38 |

| 0255909 | 'K' LINE RORO BULK SHIP MANAGEMENT CO LTD | 24 | 1.38 |

| 0778064 | COLUMBIA | 15 | 1.47 |

| 5287602 | SYNERGY MARITIME PVT LTD | 40 | 1.73 |

| 1314173 | EASTERN PACIFIC SHIPPING PTE LTD (EPS) | 13 | 1.77 |

| 1983906 | BERNHARD SCHULTE SHIPMANAGEMENT (SINGAPORE) PTE LTD | 25 | 1.80 |

Recognised Organisations & Accredited Marine Surveyors (AMS)

Recognised Organisations (ROs) are authorized to undertake survey and certification functions on behalf of flag States. There should be a careful distinction between an RO who issues or endorses Statutory Certificates on behalf of an Administration and a Classification Society who issues hull and machinery and other non-statutory or ship related certificates. ROs are required to comply with the IMO RO Code (MSC. 349(92)).

During a PSC or FSC inspection, where a ship is detained, and the attending PSCO or FSCO forms the view that the defect would likely have existed during the previous survey, they may assign the RO as responsible for the defect.

AMSA periodically audits its Recognised Organisations (ROs) against the RO Code to verify compliance with AMSA Instructions to Class for RAVs. During 2023 four 4 audits were undertaken for Lloyds Register (LR), American Bureau of Shipping (ABS), Chinese Classification Society (CSS), and Registro Italiano Navale (RINA) as part of AMSA ensuring that RAVs are surveyed appropriately.

A Table of RO performance during PSC inspections can be found in Appendix 1, Table 16

During 2023, 59 audits of AMS 1 were undertaken. 30 of these audits resulted in the AMS initiating corrective actions on the vessels or their survey practices.

| Total Audits | Audits with Corrective Action | Audits resulting in Counselling Letter, show cause, variation, or revocation of accreditation |

| 59 | 30 | 5 |

Refusal of Access Directions

Australia is a signatory to various International Maritime Organization (IMO) and International Labour Organization (ILO) conventions which aim to ensure safety, environmental protection and seafarer welfare.

Ships that are not operated and managed to meet applicable minimum standards and relevant Australian laws pose an increased risk to seafarers, ships and the environment. The Navigation Act 2012 gives AMSA the power to direct that a ship be refused access to Australian ports. AMSA exercises that power on rare occasions where a ship is repeatedly detained, has a poor PSC record, or there are concerns about the performance of the ship operator. We promulgate our policy on refusing access on our website.

AMSA can issue a ship with a direction not to enter or use an Australian port (or ports) for a set period, as deemed necessary. When considering ship performance, AMSA also looks at the performance of the entire company responsible for the operation of the ship. Where the company’s performance is also deemed unacceptable, the period for which the ship is not permitted to enter an Australian port may be extended. A direction resulting from a detention will generally take effect as soon as the ship leaves the Australian port or anchorage following release from detention.

AMSA publishes a list of ships that are refused access to Australian ports on our website.

AMSA also publishes a list of “poor performing operators”. These operators have been observed to have a detention rate 1.5 times the AMSA average over two years. These operators generally have had at least 10 PSC inspections, although discretion may be used by AMSA when an operator has demonstrated particularly poor PSC performance.

AMSA analyses the overall performance of companies whose ships come to Australia. The analysis of the company’s performance is over 24 months, with a minimum of 10 inspections. Where the company’s detention rate is found to be 1.5 times the preceding 24-month average detention rate for all ships in Australia, the company is considered a poor performing company by AMSA.

Appendix 1, Table 14 lists the ships issued with directions not to enter or use an Australian port in 2023.

Appendix 1, Table 15 lists the Company’s issued with a poor performance letter during 2023.

Footnotes

1 AMS are only able to undertake surveys on DCVs (not RAVs or Foreign flagged ships)